Have you ever been stranded when your car breaks down? We have a solution for you in this article; let’s take you on an informative journey. Bottom of Form Roadside assistance can help you get back on the road if your vehicle breaks down and nearly every auto insurance policy includes this option.

Most car insurance companies partner with an existing network of businesses to either provide direct roadside assistance or arrange services on the customer’s behalf. When you call roadside assistance, the company will dispatch the service provider that’s closest and most appropriate for your situation.

Now, before adding roadside assistance to your car insurance policy, you should know what’s included.

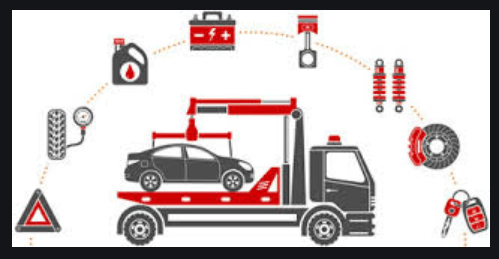

What Roadside Assistance Service Includes

- When you are stranded on the side of the road, a roadside assistance program will connect you with the right professional whether you need minor repairs, gasoline, or something else.

- Towing service providers will take your car to the nearest mechanic up to a specified distance. If you need your car towed past that limit, the provider will charge you for the overage.

- Battery jump-start service providers will restart your battery if it’s dead.

- Flat-tire service professionals will replace your flat tire with your spare. But roadside assistance might not cover a flat tire for a motorcycle or similar vehicle.

- Lockout service and locksmith service help you get into your car if you are locked out, but there’s a difference between the two. Lockout service providers typically try to unlock the car door using a pump wedge or a long-reach tool. If those methods don’t work, the provider will call a locksmith.

- Fuel-delivery service providers will deliver enough fuel to get you to the nearest gas station. If the service provider charges for this separately, they’ll use the local pump price.

- Extrication or winching services the process of moving a vehicle when it’s stuck. You may need to pay extra if it takes more than one service professional and truck to dislodge the car.

Should you get Roadside Assistance?

This depends on your car’s age, how far you typically drive, and whether you value convenience. Some auto insurance companies, auto clubs, credit card issuers, and car manufacturers offer roadside assistance.

Here’s how we consider whether the benefits are worth it:

- Vehicle age: Brand-new cars generally need less maintenance and have fewer mechanical problems, which means you could skip roadside assistance. Your car manufacturer may even offer free emergency service for the first few years or a certain number of miles. You could pay for one-off services as they arise. But if you have an older car, roadside assistance may be a good investment.

- Distance and commute: Another factor to consider is how far you typically drive when you are getting to work or running errands. If you typically stay within a small area, you might skip roadside assistance. But if you frequently take trips to unfamiliar places, then it’s a good idea to have a professional network on call.

- Convenience: If you value convenience, we think you’ll benefit from adding some type of roadside assistance program to your auto insurance policy. You won’t have to figure out which service provider is best suited for your needs. This can be especially helpful when you’re stranded late at night or during inclement weather.

- Costs: Roadside assistance programs negotiate prices with service providers and pass on the savings to members, which can help you save money. Plenty of roadside assistance members use the service several times a year.

- Free roadside assistance: If you already have access to free services, then you should take advantage of them. Some credit card issuers and car manufacturers provide their own free services though restrictions may apply.

Bottom of Form

Which Insurance Companies Offer Roadside Assistance?

Most auto insurance companies offer roadside assistance as a policy add-on, but benefits will vary. Below, we outline programs that are offered through the largest auto insurance companies.

Farm

All-State Farm drivers can use the company’s roadside assistance feature. If you didn’t add the benefit to your policy, you’ll just pay a fee for the services you use. The price is usually less than the market rates. State Farm’s emergency roadside service includes all the basic features, but mechanical and locksmith labor is limited to one hour. The time limit should be enough to resolve most issues, though.

GEICO

The big selling point of GEICO’s roadside assistance add-on is that you can request help through GEICO’s mobile app rather than calling the company. You can save your policy information in the app and let the company locate you with GPS. GEICO’s location tracking can be helpful if you ever find yourself stranded without a sense of where you are.

Allstate

Allstate offers three tiers of service by far the most options when it comes to roadside assistance. The third tier, Allstate Motor Club, offers the most features and can also be purchased as a stand-alone service. If you’re interested in benefits beyond towing and tire changes, Allstate’s Motor Club is a great choice as it provides trip interruption coverage and a personal concierge.

Progressive

Progressive’s emergency roadside assistance program offers all the basic coverage you’d expect, including flat-tire changes and battery jump-starts. Additionally, policyholders can benefit from Progressive’s lenient towing guidelines. Most insurance companies only include free towing up to a certain distance, but Progressive will tow your car more than 15 miles if there isn’t a qualified repair shop within the area.

USAA

Much like other large insurance companies, USAA offers basic features with its roadside assistance add-on. The main drawback is that you’ll have to pay out of pocket for the services provided and then wait to be reimbursed.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest