If you are into real estate investment crowdfunding, there is an ideal way to achieve more of your goals. That is what we are going to discuss right on this blog post. So, keep in touch with what you find here. Besides, they are the best basics you need for your real estate investment.

Firstly, what is real estate Crowdfunding?

Crowdfunding in real estate investment is a commercial way to invest into real estate. Thus, it’s now often used in recent years. Do you know what? This method is profitable in a great way. Now that you have known it’s lucrative, let’s see if this is the best risk to take on your investment goals.

What is Crowdfunding?

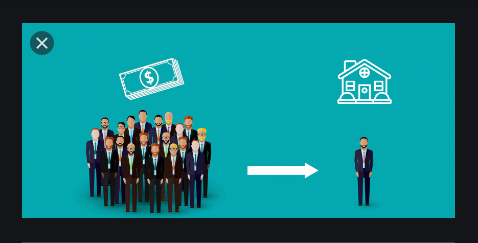

Here, Crowdfunding involves a group of people who team up their money together to hit a particular target or goal. Crowdfunding is a principal act that can also work outside real estate investment. For instance, it can serve as a source to fund health expenses when the person cannot afford the bills. In other words, it’s a charitable activity. So, real estate is a good place to apply for Crowdfunding.

To break it down, Real estate Crowdfunding is all about investors that team up in ransom to handle a specific real estate deal. What if there is a need to renovate a building that is foreseen to be lucrative, Crowdfunding can be the best way to handle it faster. So, invite your following investors to buy the idea, As you share the expenses equally. Sometimes, you might have a higher part of the demand to meet because you employ the help of other investors.

How this works is simple, let’s find out

This idea is not for a greedy investor. That is to say, you must have to give other investors the opportunity to earn a share in a project you identify. Real estate Crowdfunding investors don’t always have all it takes to complete a project. Thus, that is why they allow other investors to complete a project capital.

Mind you, there are three role managers in this system. Here are there:

- The sponsor

- Crowdfunding platform and,

- The investors

Their roles in details:

The Sponsor

At first, they must be someone or a company that identified an investment opportunity. Thus, there are called the sponsor that is their role. Here is their duty:

- They estimate the cost for the purchase of the asset

- To arrange finances

- Arrange for contractors

The Crowdfunding Platform

Here is a place where sponsors come to find investors so that the capital for the project can be completed. That is to say, each of the investors will contribute to making up the capital.

Thus, a Crowdfunding platform plays the role of a merchant. So, you come to them to find investors. They ensure you meet with certain investors of the standard you want. They can also collect investors’ funds on behalf of the sponsor.

The Investors

Here is where contributors can come in. they contribute to making up the required capital so that they can buy shares in an asset purchased.

Advantages of Crowdfunded Real Estate

- There’s high hope of higher returns in real estate Crowdfunding

- You will always benefit from every investment you make with less stress

- You can invest in an asset that would have not been possible if not through the Crowdfunding platform

- Of course, the deals here are direct and straight forward with the help of Crowdfunding platforms

- here, you will be sure of a certain return at the end of the investment

Disadvantages of Crowdfunded Real Estate investment

- Of course, real estate investment is full of risk and Crowdfunded investment is not an exemption. Thus, it places investors at high-risk, even though with high returns.

- The rate of illiquidity is high. That is to say, you can’t easily exchange cash here because it cost much more.

How to easily find Crowdfunded real estate opportunities

With the help of Crowdfunding platforms, it’s easy to find real estate Crowdfunded opportunities. They will first vet the deals before letting you know of it.

However, you should make sure you flow with the platform’s vetting process so you will be sure of where you invest in. you should be sure they vet well before allowing the project is marketed.

So, look out for platforms with real investments you want to venture into. SO, you should be able to tell the experience of the sponsor. This makes it that you will have a streamlined capital to put in.

They should be able to offer you sponsors that have specified internal rate of return for their investors. Thus, the target holding period should be known. That shows a serious sponsor and is ideal for investors to work with.

Requirements for Crowdfunded real estate opportunity

- At least $1 million in net assets, excluding the value of your primary home

- At least $200,000 in annual income for each of the previous two years

Four types of Taxes you will partially face in real estate Crowdfunding

- Income tax: even though you invest in properties that are lucrative, the truth remains that the tax amount will be lower than what you gain.

- Capital gains tax: what if a property was sold more than its estimated price, this capital gains tax will act upon your profit. So, you should have this in mind. Most especially when the investment lasted for more than a year before it was sold.

- Depreciation recapture: remember that tax is depreciation recapture. So, expect that any cumulative depreciation benefits you receive will be taxable as ordinary income

- State taxes (and not necessarily in your own): Note that when you own investment in a different state, each of them will be under the tax jurisdiction.

Hope you have restructured your mind towards real estate investment. However, it could be that Crowdfunded real estate investment is the best for you.

Don’t forget to share your comments about this blog post. It’s vital you help others build their trust in their business plan.

Social Media: Wikipedia