Run Payroll | Square Payroll | QuickBooks | SurePayroll | ADP Payroll | Patriot Payroll

Payroll plays a crucial part in any small business and if managed efficiently then it can help you to focus more on strengthening the foundation of the business, without having to worry about managing the employee of your business and things related to them.

The following are some steps to run and manage payroll for small businesses:

Step #1: Collect payroll information

When learning how to manage payroll for a small business, you need to know how to set up payroll. To get started, you need both employer and employee information

Before you hire employees, apply for an Employer Identification Number, from the IRS. You need an EIN for the documents you send to the IRS and state agencies, like tax returns. To pay federal taxes, register for an EFTPS(Electronic Federal Tax Payment System) account. With EFTPS, you can conveniently pay taxes. You also need to check if you need employer ID numbers for state and local governments. And, register for your state’s new hire reporting account.

Done collecting employees’ information. Have your employees fill out Form W-4, Employee’s Withholding Allowance Certificate. Form W-4 determines the amount of payroll taxes you need to withhold from employee pay and also collects information on benefits like retirement plans of employees.

Step #2: Choose a payroll system

You can choose to manage your payroll in three different ways- by hand, outsourcing payroll or using a payroll system.

When you do payroll by hand, you must figure out the amount of taxes to withhold. It can be difficult to master the many payrolls best practices on your own while trying to run your business.

For outsourcing payroll, you can hire a payroll consultant, as a payroll accountant, to help you withhold and deposit taxes.

If you decide to use payroll software, compare factors like features, cost, support, ease of use, and security between software providers. Consider payroll software reviews before making any decision.

We specifically recommend payroll system/software and guide like how to run Square Payroll, run QuickBooks payroll, run SurePayroll, run ADP payroll & run Patriot payroll. Click any of the software and follow the guide on their official page to run payroll using each of the payroll systems.

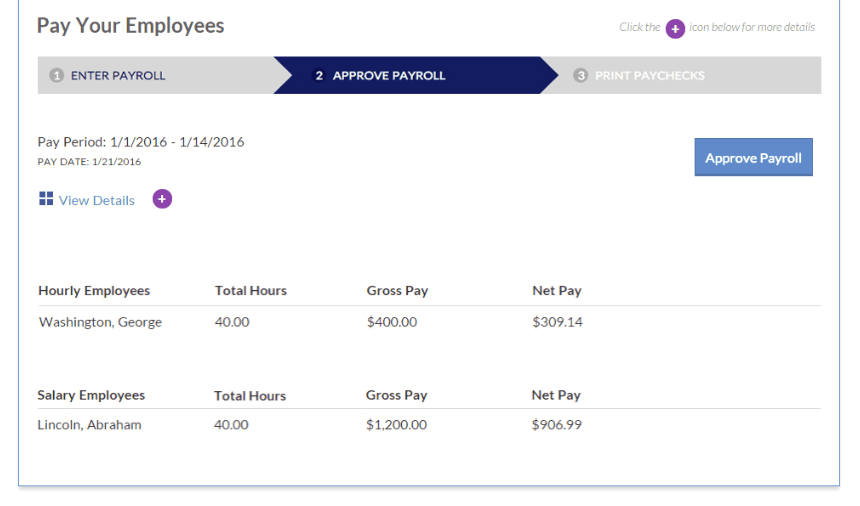

Step #3: Run payroll

The next step is to run payroll after choosing the payroll system. The payroll system you use will determine how you need to run payroll. Enter the hours your employees worked during the pay period, account for any overtime if non-exempt, and withhold the appropriate taxes. After you’ve determined the payroll is correct, pay them via their chosen payment method.

Step #4: Handle taxes

You are required to withhold, deposit, and report Federal income tax, State and local income taxes (if applicable), and FICA tax (social security and Medicare taxes). And, when you’re an employer, you also need to pay taxes on employee wages. Federal unemployment (FUTA) tax and state unemployment (SUTA) tax are your responsibilities.

Step #5: Keep records

You need to keep payroll records for each employee. In payroll records, you must keep documents like the employee’s Form W-4, pre-tax and post-tax wages, and total hours worked each workweek.

So, these were some steps that are essential for the efficient and effective management of payroll for small businesses and startups.

Run Payroll: Square Payroll

Square Payroll helps you pay your whole team in just a few clicks – by importing employees’ timecards or entering your employees’ hours. The software calculates all the taxes for you, and even email your employees to tell them they’ve been paid. Sounds good right?

Here’s a step-by-step guide on how to run payroll with Square

- Firstly, Log in to your Square Dashboard

- Next, click Payroll

- Run Payroll

- Enter your employees’ hours and earnings for your upcoming pay period. Tips: Tracking timecards or partner timecard app with the Square app;

- Also, Click Import Timecards in the top-right corner. Your employees’ hours for the pay period automatically appear in the appropriate column. Tips: Not using integrated timecards or would prefer to manually enter employee hours, simply click the Regular Hours column and type in each employee’s hours.

- Lastly, click the plus sign on the right side of the screen to select the columns you need and add additional earnings such as commissions, & bonuses.

Types of hours and earnings you can capture with Square Payroll

Regular hours – are the number of hours worked during the pay period that is calculated at the hourly rate.

Overtime hours – are calculated at one-and-a-half times the hourly rate, and double overtime at two times the hourly rate. The Additional column lets you include any extra earnings, like commissions or bonuses.

These are taxed at the normal rate. You can also add any tips your employees have earned. Paycheck tips are tips to be paid out in the paycheck, typically credit card tips.

Square payroll withholds tax and includes the net amount in the employee’s deposit. Cash tips are tips already paid out in cash.

Square payroll calculates and withhold the tax, and don’t include this payment in the employee’s deposit.

- Firstly, Once you’re finished with the hours and earnings page, click Continue in the top-right corner.

- You can make any adjustments to your employees’ paycheck. Deductions can be adjusted on this screen, or add to an employee’s profile at any time.

- Select Continue when you’re done. Now you can see the Review page with a summary of the payroll run and the exact amount to be withdrawn from your bank account.

- Lastly, Click Confirm Withdrawal.

Your funds will be withdrawn from your bank account by 8 p.m. Pacific Time. If you need to cancel the pay run, you have until 7 p.m. Pacific Time.

Over To You

Done with your set up? Let’s help you with all of your challenges in regard to managing your payroll processing software. Alert us with the comment box below. We will be willing and delighted to help.